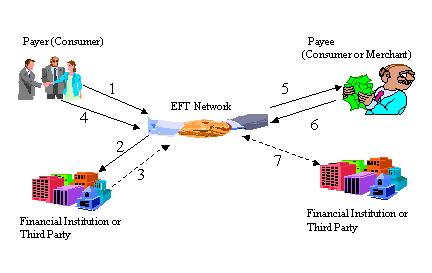

An Electronic funds transfer is a financial transaction that takes place over a computer network. The process allows customers to transfer funds between accounts within the same bank as well across different financial institutions.

The electronic fund transfers include direct deposits, wire transfers, direct –debits, online bill payment services, ATM withdrawals, point-of-sale transactions and more. In a typical electronic fund transfer, an Automated Clearing House (ACH) network securely processes the financial transactions. The ACH is basically a secure transfer system that connects all financial institutions such as credit unions, banks, etc.

Typical Uses of Electronic Funds Transfer

Credit or debit card

EFT helps in transferring the money electronically from a buyer’s account and into that of the seller. This is probably the most popular form of EFT payment due to its convenience and flexibility.

Online bill payments

This involves making payments through online banking systems. This is a fast-growing mode of payment that is also convenient hence allowing more people to settle their monthly and other bills in electronic format. What is even making it better is the ability to pay through mobile phones and devices, hence allowing consumers to pay from anywhere in the world.

Direct deposit

Most employers prefer to pay their employees through the direct deposit method. This allows them to deposit the salaries to compatible bank accounts, hence making the process faster and save on the costs of writing and delivering cheques or any other manual payment processes.

Direct debit

This works like electronic checks and some organizations or individuals may configure it as a monthly auto-draft for recurring payments. In such an arrangement, the customer instructs the financial institution such as the bank to automatically transfer a certain amount of money from the account to pay for monthly services, bills, etc.

Benefits of EFT

Electronic funds transfer provides an easy, cheaper, and faster method of transferring money.

- It helps individuals and organizations to save on costs such as printing checks as well as the time to deliver or collect checks and deposit them in the banks for processing.

- The money moves to the recipient’s account much faster since there is no manual moving of checks from one bank to the other.

- It is more efficient

- Has less administrative procedures, hence reduced labor and staff costs

- An electronic funds transfer is much safer and secure. For instance, it eliminates the need to carry huge amounts of money.