An EFT switch is an integrated system with the ability to accept, authorize and securely route financial transactions according to set rules.

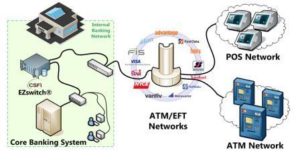

The Electronic Funds Transfer switch provides a crucial link between multiple customers’ touchpoints and a financial institution’s back-office system, hence allowing the banks to deliver multiple self-service channels.

The self-service features allow the banks to improve efficiency and customer experience, increase their transaction volumes while at the same time lowering their operating costs. On the other hand, customers can transact more and acquire various over-the-counter services without being confined to the traditional banking halls and hours.

It provides a crucial link between multiple customers’ touchpoints and a financial institution’s back-office system, hence allowing the banks to deliver multiple self-service channels. The self-service features allow the banks to improve efficiency and customer experience, increase their transaction volumes while at the same time lowering their operating costs.

On the other hand, the customers can transact more and acquire various over-the-counter services without being confined to the traditional banking halls and hours.

The flexible and scalable EFT switches support a wide variety of financial transactions, products as well as multiple electronic delivery channels and devices, and most of all, they are highly customizable to meet the unique requirements of the different institutions. Small banks and institutions wishing to use the national payment network without investing in in-house IT infrastructure can use hosted or shared EFT switches.

During a transaction, the EFT switch acquires the message generated by the customer and then securely routes it to the customer’s or merchant’s bank account. This enables the banks to seamlessly route and authorize financial transactions across the traditional and modern channels, hence enabling customers to perform over-the-counter functions from mobile devices, ATMs, POSs or other touchpoints. In addition, the EFT switches have other features such as generating inter-institution settlements information, as well as maintaining the accounting and audit trails.